Capital Budgeting Assignment Help

Want to score high marks in the tough assignments of Capital Budgeting Assignment Help? Get in touch with us quickly through Live Chat!

Capital Budgeting Assignment Help: Get Dream Assignment's Expert Help in the USA

Are you confused with the capital budgeting assignment? Well, then it’s time you get in touch with us to get the best possible solution and help with this problem. We are considered the best assignment writing service provider in the USA that has been offering services to students for more than two decades now and has served more than thousands of students from around the globe. All our services are provided by experts only and hence we ensure that no type of plagiarism will occur throughout your work.

What is Capital Budgeting?

Capital budgeting is a strategic approach to making decisions about whether and how much to invest in new capital goods. These capital goods can be tangible, such as trucks or computers, or intangible, such as patents or branding. It includes an analysis of projects that are expected to have a positive net present value (NPV). Capital budgeting can help determine which investment opportunities should be pursued and when. To ensure proper allocation of resources across all potential projects, management must use a decision-making framework that ranks projects according to their NPV. The typical steps involved with determining an NPV include.

Capital Budgeting refers to the process of determining, contemplating as well as evaluating a large number of potential expenses that are often invested in long-term ventures. Generally, the term ‘Capital’ implies the fixed assets and “Budget’ refers to the planning of expenditures. It is probably the most useful instrument in the areas of corporate financing for making the decision on whether a proposed project is advantageous or not. It is also used for resource allocation (for the upcoming projects) and investment appraisal.

Capital Budgeting assignment help is considered one of the toughest finance assignment topics. To make efficacious financial planning in a company, understanding capital finance is very important. Students often face difficulties to solve capital budgeting homework help chapters because of the lack of measurability, knowledge, accountability, and brainstorming techniques. So, Dream Assignment is here to provide comprehensive assistance to those students on capital budgeting exercises and solutions.

Why should you use capital budgeting?

Capital budgeting, also known as capital budget planning, is a method that businesses use to determine whether or not they should invest in a project. The fundamental question that these companies ask themselves when doing so is whether the investment will help them achieve their overall financial goals. A company has numerous financial objectives that it must balance, and it uses capital budgeting to sort out which investments will bring them closer to achieving those goals.

When attempting to answer that question, business leaders have five main categories of factors to consider when deciding whether or not a certain project is worth pursuing.

These factors are Net Present Value (NPV), Internal Rate of Return (IRR), Payback Period, Cash Flows, and Stages of Development/Operation.

If you're looking for more information on how to calculate net present value, internal rate of return, or any other aspect of capital budgeting, be sure to visit us for step-by-step instructions.

Why Capital Budgeting Assignment Help is Necessary?

Various capital budgeting methods include long-term risks and returns on potential expenditures. It also involves a decision-making process on the current funds for disposition, addition, moderation, or substitution of fixed assets. So, students doing capital budgeting homework help have to be sound knowledge and an in-depth grip on the wide field of corporate accounting and finance. A lot of studies and hard work are needed to score a standard mark in this domain.

If you too are overlaid in this situation, then connect with our professional team & build your Capital Budgeting Homework Help in a unique way. We give proper assistance to the scholars and students in calculations, thesis writing, as well as supreme capital budgeting assignment excel solutions, top notch quality. Thus, Dream Assignment is recommending you get capital budgeting assignment help from our experienced native experts & score higher.

What is the Importance of Capital Budgeting?

The importance of capital budgeting homework help is discussed as follows. Capital budgeting creates a step-by-step process for the company for:

●Formulation and development of long-term strategic goals

:It creates a future framework to plan a long-term direction via value investment projects. It is necessary for the prosperity and growth of a business entity.

●Forecasting and estimation of future cash flows

:Features of capital budgeting include taking a potential project and estimating the future outcomes. This technique helps to decide whether the project should be accepted or not.

●Seeking new investments

:Capital budgeting methods evaluate various new projects that enable the organization to establish an investment model in the industry.

●Monitoring of expenses

:The essential expenditures (R&D) are carefully identified by this technique, as well as controlled and monitored.

●Creation of appropriate decision

:Capital budgeting assignment helps to make effective decisions on investment planning. It has two aspects: investment decision and financial decision. By approving a project, a business has to make a financial commitment, which is encompassed by cost overruns, a set of risks, regulatory restrictions, etc.

What are the Various Types of Capital Budgeting Techniques?

If you are interested in capital budgeting assignment help, then you have to understand several capital budgeting methods that are profusely used in making long-run decisions. We are hereby discussing some of them:

●Accounting Rate of Return

:Also termed the Average rate of return, this financial ratio helps to compute the return, which is generated from the capital investment’s net income. Formula: [Avg Net Profit/Avg Investment].

●Payback Period

:It is the time period for a proposed investment to recoup its initial outlay and reach break-even, in terms of savings/profits. It’s an important method to make dividend decisions. But it ignores the opportunity cost and time value of money concepts.

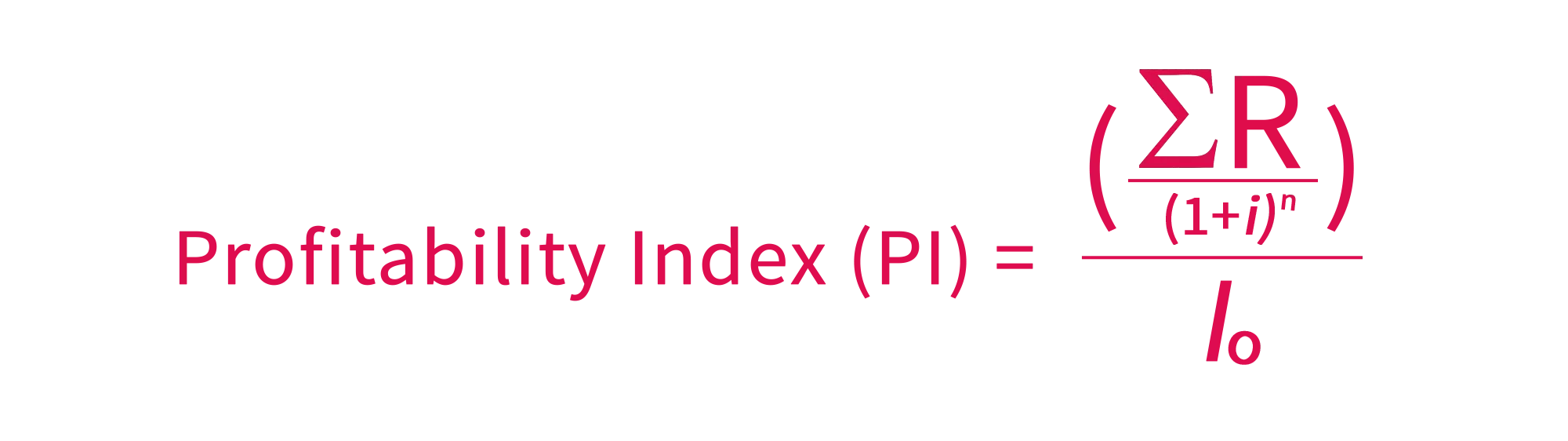

●Profitability Index

:It is one of the most useful capital budgeting techniques to determine the rank of a proposed investment. It is the payoff ratio to the speculation. Formula: [Present value of cash flows/Initial investment].

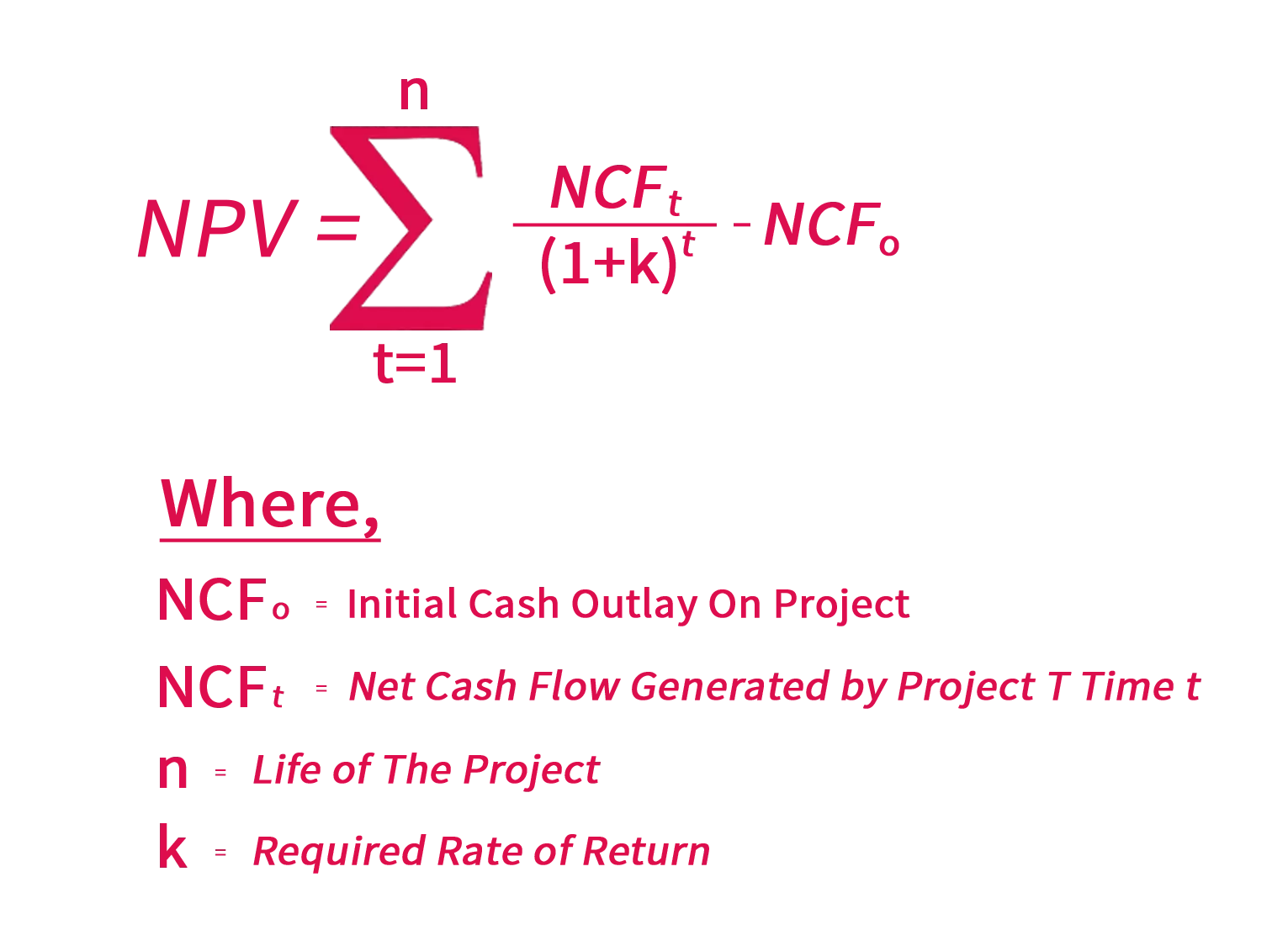

●Net Present Value

:NPV means the net difference between the P.V of cash inflows and P.V of cash outlay for a particular period of time. It is used for analyzing and planning the profitability of the capital investment. Here, each project’s value is calculated using a DCF (Discounted cash flow) method to find the exact present value. So, NPV is based on the discount factor (hurdle rate) to measure the financing mix as well as the volatility of cash flows. For the application, the NPV method is used in CAPM or APT model, or in the estimation of WACC. To get more on NPV, you can visit capital budgeting homework help on Dreamassignment.com.

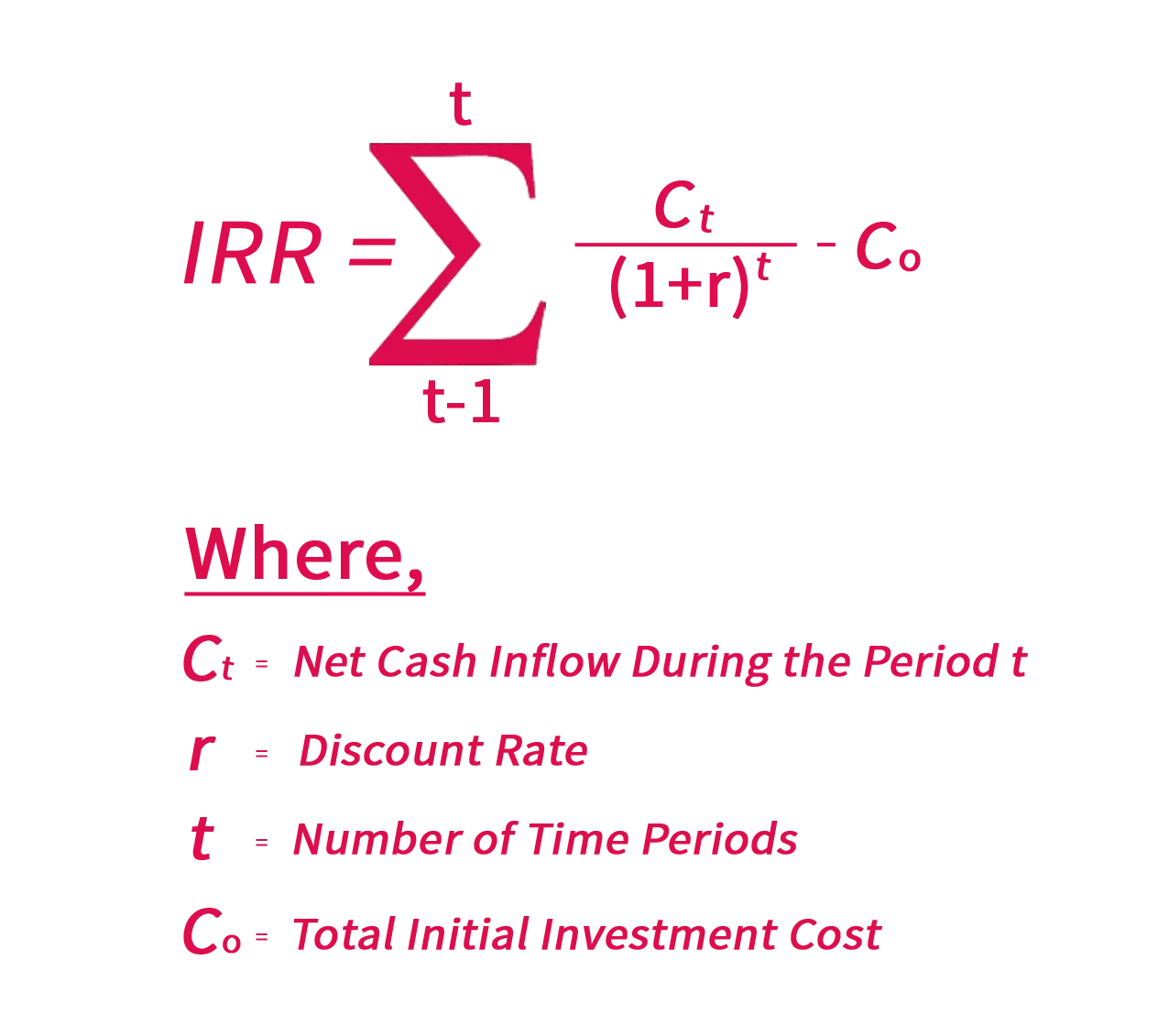

●IRR and MIRR

:The internal rate of return (IRR) is the discount rate where the proposed investment of a project reaches a breakeven point. In other words, in that discount factor, the PV of all cash flows is equal to zero. Higher the IRR, the better the ranking.

The modified version of IRR is called MIRR. It assumes that initial outflows are financed in firm’s cost of financing besides its cost of capital goes higher by the reinvestment of cash flows.

Why Choose Dream Assignment for Capital Budgeting Assignment Help?

These days, students are focusing not only on academic and theoretical knowledge but also the practical lessons in the capital budgeting homework help, to overcome the upcoming challenges in corporate finance. It has been seen that students face difficulties and complexities in getting capital budgeting assignment solutions, failing to make their assignments within-guideline, lacking knowledge and brainstorming techniques, etc.

Dream Assignment is providing you with a requisite solution for your capital budgeting homework help. We have many potential experts in this field having in-depth knowledge and good practical experience in the miscellaneous topics of capital budgeting. They can serve the quality to accomplish your capital budgeting assignment help within the stipulated time. You may face problem while generating the ideas of project evaluation, project financing, and project approval stages. The subject matter experts will help you to aid in a high level of critical thinking and strong grip in the topics in capital budgeting homework help.

What are the Major Features of Capital Budgeting Homework Help?

●Specialization

:Dream Assignment is a specialized team, that provides the best solution to clients. The diversity of various services makes our team skillful and specialized.

●Work Quality

:We produce excellent quality work and gather mass support. Capital Budgeting exercises and solutions are provided on the basis of proper assessment, in-depth study-based analysis, and skillful technique. It covers a vast area of capital financing as well as decision-making.

Our capital budgeting homework help services are provided in many countries. In the USA, we provide our services in the sub-continent of New York, Washington, Texas, Los Angeles etc.

●In-Depth Research

:Our experts and writers do thorough research about the topic to get the finest solution in the end. Moreover, your assignment will reflect calculations, and facts that make the project more informational and authentic.

Now Capital Budgeting Assignment Help is Simple and Easy! We’re here to help you!

You can also have a look at the following additional features provided by us:

● Plagiarism-free content

●Affordable prices for the students

●24*7 customer support

●Unlimited revisions

●Error-free content and many more.

Capital Budgeting Assignment Help provides the best perfection, price, customer services, privacy & quality guarantee to our clients. So join your hand with us to fulfill your success dreams on capital budgeting study.

What are the benefits of using capital budgeting?

Successful businesses are those that make money. In order to earn a profit, a business must cover its costs. To cover those costs and generate profits, a business needs to have enough income coming in to be able to do so. Thus, it’s vital for businesses to have plans for earning revenue; otherwise, they will not be able to remain successful over time. Capital budgeting is one effective method of planning for revenue. It helps you determine which capital investments are likely to lead to greater revenues for your company. These investments may include new products or services, additional facilities or equipment, or other initiatives. When you use capital budgeting as part of your overall financial strategy, you can more effectively plan for future growth and profitability. You can learn more about how using capital budgeting can help your business by speaking with our experts at Dream Assignment! We offer assistance with all aspects of capital budgeting assignment help online at competitive prices!

When does capital budgeting make sense?

Using capital budgeting can be helpful for business owners and managers who want to decide whether it makes sense to start a new project, purchase or upgrade equipment, or move into a new facility.

To make a decision about whether you should use capital budgeting to evaluate your project, you will need to answer three questions:

(1) Can you identify all of your relevant costs?

(2) Can you accurately estimate future cash flows?

(3) Are there any externalities that would significantly affect your analysis?

If you can answer yes to all three questions, then capital budgeting is likely worth your time.

Remember, if you are using financial accounting methods like accrual accounting, then capital budgeting isn't necessary because financial accounting already accounts for the depreciation and amortization of assets over their useful lives.

You'll also need to think about how much risk you're willing to take on when evaluating projects with different net present values. The higher the NPV, generally speaking, the greater amount of risk associated with that project because there is more uncertainty around how much money it will bring in down the road.

Of course, if an opportunity has a negative NPV, then it shouldn't even be considered by anyone regardless of their appetite for risk because it represents wasted resources as well as lost profit potential. So what does all of this mean?

Capital budgeting is a good way to help determine which projects should be pursued and which ones shouldn't. It helps identify which opportunities have high expected returns relative to their risks and which ones don't. And it provides some guidance on how much funding you might need from outside sources—like investors—to support those projects so they become reality. It doesn’t tell you everything, but it does give you some valuable information to help make better decisions about where your company goes next.

Where can you apply this strategy?

Capital budgeting is an important strategy for businesses to evaluate potential investments. It calculates whether a particular project or business decision will have enough benefit over its lifetime, given all costs. Before you embark on any new projects, it is good practice to review your capital budget and determine if there are any possible sources of financing you haven't tapped into yet.

Once you've decided on a project that best fits your company's mission statement and goals, here are some things to keep in mind during each stage of project management. The main goal of a capital budgeting analysis is to help companies make decisions about investing in major projects by quantifying how much profit they expect from them. These types of calculations also allow companies to set aside funds for future expenses related to these ventures. In short, when used properly, capital budgeting can help you avoid making impulsive investment decisions based solely on emotions or expectations.

Here are some common pitfalls companies fall into when conducting their own analyses:

* Choosing too many alternatives

* Choosing alternatives with insufficient justification

* Not calculating returns at an acceptable level of risk

* Not accounting for taxes and interest rates

How do we address these problems?

By using our professional skills and expertise to guide you through the process. Our team members are not only highly trained professionals but also seasoned experts who have successfully completed numerous capital budgeting assignments for various industries across North America. We work with students on both undergraduate and graduate levels as well as working professionals who want to learn more about capital budgeting strategies so they can use them at work. To get started, just place your order now!